Before the pandemic hit, I was hearing a lot of chatter in QuickBooks communities about increasing motor vehicle expense audits. So, here’s a couple tips to record and track mileage.

(Psst… If business operations have slowed down in your company, now might the perfect time for you to implement new systems.)

A backstory

Twenty years ago, I was a teenager in my first bookkeeping job. A CRA agent traveled to Fort McMurray to visit the company I was working for. He parked himself in the company’s admin offices for a week to do a full audit. (The comptroller was NOT happy. This guy was questioning all of her work. And she did not like to be questioned.)

And the end of the audit process, the agent concluded the company’s owner was using the company truck for personal use. There were no records to prove how the company’s vehicle was being used for company purposes. So the owner had to claim a big chunk of the truck expense as a personal tax benefit. He owed the government $750. All of it was because the vehicle record keeping was insufficient.

Otherwise, the audit went smoothly because the comptroller had impeccable records! The only place the company fell short was tracking motor vehicle use. (You can bet the comptroller implemented a mileage tracking system after that.)

So what?

If you haven’t faced an audit, please believe me when I say, “It’s painful.” It is time-consuming and impacts productivity. You don’t have a choice to cooperate with an audit, no matter how long it takes. Worst of all, it can get expensive!

The better your records are, the easier the process will be. You should already have a system in place to track all income and expenses. You should also have a system to track your mileage.

Mileage tracking tips

1. Know what information the government needs.

The Canadian government requires specific details about mileage:

- Date

- Destination

- Purpose

- Number of kilometres

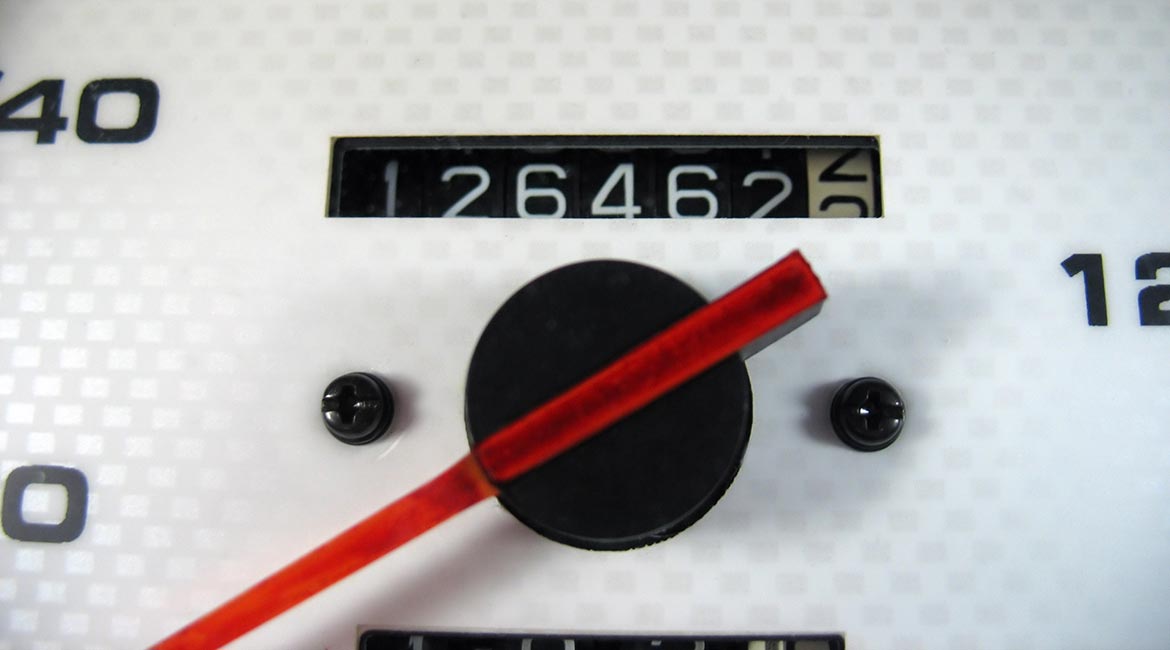

- Odometer reading at start and end of each fiscal period

2. Create and use a tracking system.

Find a system that’s going to work best for you. You might have to try a couple different systems to see what you like best, and what works well with the people in your company.

Some examples:

- Keep a log book in your vehicle if you’re the only one driving it. Put it in a place where you can see it and you won’t forget to use it.

- Use a GPS mileage tracker on your phone. I use TripLog because it integrates nicely with QuickBooks Online, but there are quite a few good options. Leave a comment below on your vote for the best mileage tracking app!

- There might be many people driving one company vehicle. In that case, keep a set of mileage log forms on a clipboard inside the vehicle.

- If your employees are submitting mileage, give them a form to use.

3. Plan – Do – Check – Adjust

This is a tool pulled from lean thinking.

- Plan your mileage tracking system.

- Do (Implement) your mileage tracking system.

- Check your mileage tracking system. What’s working? What’s not working? What are the barriers? What are the additional areas of improvement? Make sure the system isn’t top-down! Ask your employees for their feedback on the system.

- Adjust your mileage tracking system based on the feedback you get. Remember, if the users like the system, it is more likely they will use it.

Questions?

Please email me if you have any questions. I can give you some input on your current system. I’d also be happy to show you how I set up my system with TripLog and QuickBooks Online.